- Community development financial institutions offer an alternative source of funding with higher approval rates

- CDFIs seek to broaden economic opportunities for low-income and minority communities

- The pros and cons of using CDFIs for your business financing needs

By Kempton Coady, General Manager

Under the best of circumstances, getting small business financing is no sure thing. In the 2020 Federal Reserve Small Business Credit Survey, 17 percent of small businesses said they had been denied financing.

It can be even harder for underserved or less formal small-business owners to access capital. There may be fewer traditional financial institutions like banks or credit unions in your area, or you may have tried to get financing at those institutions but didn’t meet their underwriting or documentation requirements.

If either is the case, an alternative option is financing from a community development financial institution, or CDFI, which may have higher approval rates.

What is a CDFI?

Several types of institutions can serve as a community development financial institution, including banks, credit unions, loan funds and venture capital funds, according to the CDFI Fund, an arm of the Treasury Department that supports CDFIs through financial and technical assistance awards.

CDFIs’ goal is to broaden economic opportunity among low-income and minority communities by providing access to basic financial services for individuals and businesses. CDFIs provide a range of financial products, like mortgages for low-income and first-time home buyers and commercial loans for small businesses. About 950 CDFIs are in operation across the country.

Small Business CDFI Loans: Pros and Cons

Pros

Low interest rates: Rates for CDFI loans are competitive with those you will likely find from other sources, such as banks that issue Small Business Administration loans. A study of CDFI financing commissioned by the CDFI Fund found that the median interest rate in 2019 for a CDFI-originated business loan with a 48-month term was 7.75 percent. In comparison, rates in April 2017 for an SBA 7(a) loan under $25,000 and paid off under seven years were around 8 percent. Rates for online lenders are generally higher and can reach into the high double digits.

Higher likelihood of approval: CDFIs generally are more likely to extend credit to borrowers that traditional banks would deem too risky, says Ayrianne Parks, a spokeswoman for the CDFI Coalition, a Washington, D.C.-based advocacy group. The proof is in the numbers. According to the Federal Reserve survey, the approval rate for small businesses that applied for loans or lines of credit from CDFIs was 77 percent. That was higher than at online lenders, credit unions or banks of any size.

Simpler products: The financial products CDFIs offer generally are “plain vanilla,” according to the CDFI Fund study, meaning they’re designed to minimize the borrower’s risk. Most of the loans are fixed rate, which means the borrower’s payments are predictable. In addition, they’re self-amortizing; as borrowers make payments, they’re paying interest and chipping away at the principal so that the loan is paid off at the end of the term. Origination fees are low, and in many instances, nonexistent.

Business development help: CDFIs offer technical assistance and training programs to small businesses to help them get started and grow sustainably. Some offer mentoring and advisory services.

Cons

Not for everyone: To be certified by the federal government as a CDFI and be eligible for CDFI Fund money, organizations must have a primary mission to promote economic development and must serve an underserved area or population. If your business isn’t lacking resources, opportunity or access to financial services, chances are that a CDFI is not the right path for you.

Longer funding time: The application process and time to funding can take longer at CDFIs than at other types of institutions. CDFIs generally have fewer assets than banks, “so a loan application may be delayed because a CDFI may not have enough bandwidth to fund everything in their pipeline,” Parks said. By contrast, online lenders can fund loans in days or weeks.

CDFIs today

There are over 950 CDFIs certified by the CDFI Fund. CDFIs operate in every state and the District of Columbia, serving both rural and urban communities. The Opportunity Finance Network (OFN) is the National Association of Community Financial Institutions, and includes a CDFI Locator tool to help find institutions near you. It also offers information on how to apply for financing.

CDFIs generally work through banks from throughout the country. They are a collaborative force that brings together diverse private and public sector investors to create economic opportunity in low-income communities. CDFIs continue to grow and impact, and to support community transformation.

CDFIs also offers a variety of distinct programs to benefit small businesses. These include the following.

- Finance Justice Fund

- Grants funded by Google.org

- Grow with Google Small Business Fund

- Native CDFI Awards

- Renewable and Energy Efficiency Funding

- Wells Fargo Diverse Fund

- Community Capital Partnership Program

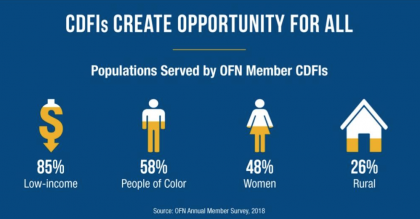

Breakdown of some of the major groups CDFIs funded

CDFIs are driven by a mission to provide financial opportunities to all people. CDFIs offer small business financing—with products ranging from relief and recovery loans to financing for working capital—as well as technical expertise to help you succeed. The following image shows the segments of the economy which have benefited most from CDFI financing.

Alternate way to find a small business CDFI loan

To find a CDFI in your area, visit the Treasury Department’s searchable award database or the Opportunity Finance Network’s CDFI locator.

To apply for financing, small-business owners likely will need to provide the same kinds of information they would at a bank: personal and business tax returns, personal financial statements for all business owners, lease agreements, bank statements, income statements and balance sheets.

Compare small business loans

If your business isn’t eligible for a CDFI loan, online lenders may provide an alternative. Online lenders specialize in simplifying the loan application process and in offering credit to a wider variety of businesses at competitive interest rates for strong-credit borrowers and often more quickly than banks.

If you’d like more help with finding the right solution for housing your startup, InnovatorsLINK offers a detailed Bootcamp course where you’ll learn the details about all your options. Register here.

Review the Executive Summaries associated with each course prior to attending the courses.

InnovatorsLINK, Inc. General Manager and Chief Financial Officer

A SENIOR LEVEL EXECUTIVE with over 30 years successful, results-oriented domestic and international experience in the MEDICAL DEVICE BUSINESS. A Business Leader who created significant increases in profits and cash flow and/or raised money to expand enterprises. A Leader, who attracts and motivates the best talent to achieve the desired results. Board member for AMEX, NASDAQ, and London Stock Exchange companies. Significant international experience in Europe, Latin America, and Japan. Experience the last seven years has included Professorships at Goldman Sachs 10KSB program and University of Connecticut Graduate School of Business. Earned BS Bates College, MBA and MPS Cornell University.

This Expert Summary is © InnovatorsLINK. For republishing, please contact dlangeveld@innovatorslink.com.